Daycare Tax Deductions: Save Big with IRS-Approved Benefits

Discover essential daycare tax deductions for your daycare business, from travel expenses to childcare supplies. Get IRS-approved tips to maximize savings.

New to pre-tax benefits? 4 facts you should know, BRI

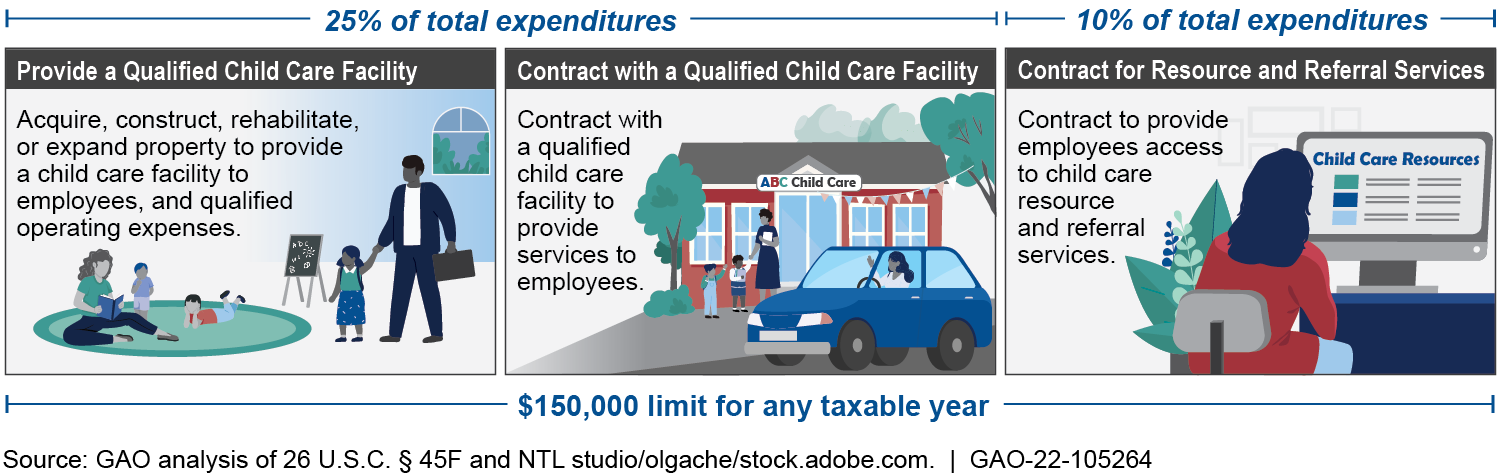

Employer-Provided Child Care Credit: Estimated Claims and Factors Limiting Wider Use

1040 (2023) Internal Revenue Service

Child Care Tax Receipt and Statements Guide & Templates

These Tax Benefits Get Unlocked When You Have or Adopt a Child

Dependent Care Flexible Spending Account (FSA) Benefits

Common Tax Deductions and Credits

:max_bytes(150000):strip_icc()/child-and-dependent-care-tax-credit-3193008_final-b08e8070d5604c59b7ab83438a7c3167.jpg)

Can You Claim a Child and Dependent Care Tax Credit?

Top tax write-offs that could get you in trouble with the IRS

10 Crazy Sounding Tax Deductions IRS Says Are Legit

Navia Benefits - Day Care FSA

Dependent Care Tax Benefits: Tax Credits & Employer Plans

More About IRS Form 8882 aka Employer-Provided Child Care Tax Credit

As child tax credits expire, here's how families used the money for 'survival

/posters-christmas-seamless-pattern-with-big-and-small-snowflakes-on-cyan.jpg.jpg)