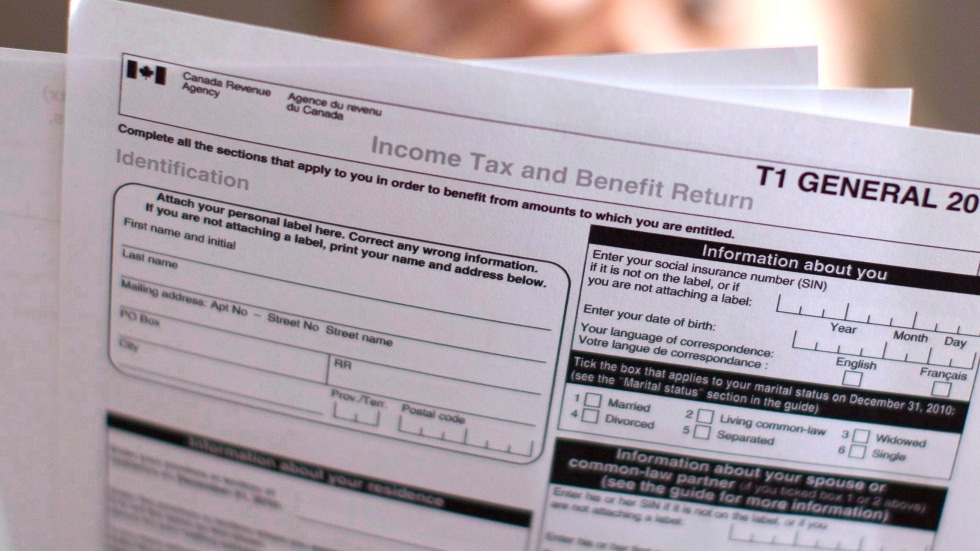

The top reasons why the CRA may review or audit tax returns - The Globe and Mail

The CRA conducts most reviews according to an undisclosed scoring system that identifies returns with ‘the highest potential for inaccuracy’

CRA cracks down on undeclared tips for restaurant and bar staff

The top reasons why the CRA may review or audit tax returns - The

Nine ways to prevent triggering a CRA tax audit - The Globe and Mail

The top reasons why the CRA may review or audit tax returns - The

Hearing on the IRS Backlog and 2022 Tax Filing Season

What's the difference between a CRA tax review and audit? - BNN

CERB audit of high-risk cases finds 65 per cent went to ineligible

The top reasons why the CRA may review or audit tax returns

CRA Notice of Reassessment: What is Notice of Reassessment and Why

These are some of the top red flags for an IRS audit, tax pros say

Church & Halverson Accounting Ltd.

PBO blasts CRA for saying 'not worth the effort' to recover $15B

ITR Global Tax 50 2022: Carmine Di Sibio

Document