The current state of 2022 pre/seed investing, by Trace Cohen Angel Investor / Family Office/ VC

We made a dozen new investments in 2021 at an average valuation of $8M — half of which were pre-product/rev. So far we have made 0 new investments this year because I have no idea where the market is…

Trace Cohen's Investing Profile - New York Venture Partners (NYVP

Venture Capital Due Diligence: The Screening Process

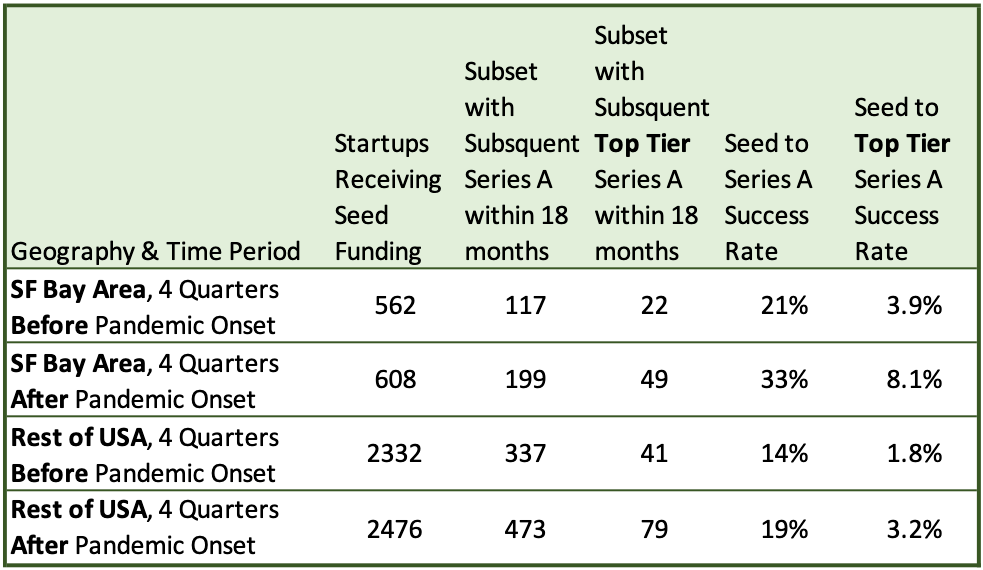

Do San Francisco Bay Area Startups Still Outperform?, by Eric Ver Ploeg

Start to Impact Invest — Part 4 — Become a scout

Venture Capital List - Database of 44 VC Lists

Solving the FOAK puzzle — Addressing Capex financing for first-of-a-kind plants in the green transition, by Climentum Capital

The Crux of Current and Historical VC Startup Valuation Inflation

Venture capital vs private equity: different objectives, different

Trace Cohen Angel Investor / Family Office/ VC – Medium

Wake me up when September Ends. I believe in about 60 days we'll

How Venture Capital Deals Impact Your Marketing and Branding

Trace Cohen on LinkedIn: Understanding Pre-Seed vs. Seed Funding Rounds: What Startups Need to Know

Venture Capital List - Database of 44 VC Lists